Author: Igor

So I am sending a message to a friend and advising him to open a premium Tinkoff card, but I am writing a long text about it. Because the map is really good. I warn you right away: this credit card option is not suitable for everyone, perhaps the standard All Airlines will be enough.

Finally, I have issued a Tinkoff All Airlines Black Edition card and am ripe for a review. This article is the second part of my big review of the premium rate from Tinkoff: in part one I started debit Black Metal, and now I will continue with credit.

Reviews in blogs about whether to open this map can be dissuasive, but for myself, I decided that yes, it is. I will tell you how to combine two cards, and how I dug out the moments that were not obvious before. For example, you can use both debit and credit, but pay for the service only for one - or, instead of 2,000 gift miles, 3,500 can come!

A little background.

Since the summer of 2020, I switched to premium service and made myself a metal Black Metal, which I wrote about in the first part and filmed a review on Youtube, see what is more convenient for you - judging by the feedback, it was useful to many! Premium service is invisible, and if you feel comfortable, then it works well. But if it's bad, you see this right away!

My experience with the All Airlines Black Edition premium card

2 Tinkoff All Airlines credit cards - regular and premium (I recently switched to a new tariff)

With the Metal debit premium card, I first fulfilled the free terms of service under the loyalty program. Now I pay 1990 rubles a month - I figured it was more profitable for me.

Why did I open a credit card from Tinkoff All Airlines Black Edition, because this is still minus 1990 rubles a month? The main argument is that if you fulfill the conditions of free service with a Metal card OR pay 1990 rubles for it, then you can get a premium credit card in addition for FREE. Accordingly, all the goodies of the two cards are combined. In addition to the passageways to the business lounges, conditions have changed since April 2021, I will insert an insert below.

Confirmation that I really use a premium plan, and not write here out of thin air, are these two buttons above - such links with bonuses are available only to real premium customers. Well, my name is mine :) Previously, they gave 2,000 rubles / miles, but now 2 months for free - that's twice as much!

The main points that I use on the map:

- First, there are 2 standard aisles to the business lounge, or 24 per year. Not that everyone is traveling around the world now, but it will come in handy for the future. True, if you store more than 3 million rubles, there will be 4 passes! But 2 is enough for me. If you are traveling with your family, you can open for everyone with a card, after the trip close 🙂

- Secondly, 2% cashback for any everyday purchases (1% on debit).

- Thirdly, the ability to "freeze" not your own money when booking hotels or cars (deposits). It's nice when it's not your hard-earned money, but the bank's money, which endure up to 55 days.

In fact, the second and third points are also on a regular All Airlines credit card. They even have the same cashbacks for travel, and it is easier to service, only 1,890 rubles a year. For it, by the way, they also give a bonus at registration - 1000 miles as a gift. And from June 1 to June 15, there is another promotion - 5000 miles as a gift. To do this, you need to spend 10,000 rubles on the card (you can use different payments) in 30 days.

I think it will be convenient to explain the advantages of a premium credit card and the differences from the basic one in the form of a table:

| Card conditions | Tinkoff All Airlines | Tinkoff All Airlines Black Edition |

| Credit limit | up to 700,000 rubles | up to 2,000,000 rubles |

| Monthly mile limit | up to 6000 miles | up to 30,000 miles |

| Miles deduction | from 6000 miles in 3000 miles increments ** | from 6000 miles and further 1 mile = 1 ruble *** |

| Interest rate per year | from 15% | from 12% |

| Cashback with miles for travel | 10% on hotels and cars 7% on air tickets * 5% for railway | 10% on hotels and cars 7% on air tickets * 5% for railway |

| Cashback with miles for other purchases | 2% | 2% |

| Interest-free period | up to 55 days | up to 55 days |

| Cash withdrawal | with a commission of 390 rubles | free up to 100,000 rubles per month |

| Travel insurance coverage | up to $ 50,000 | up to $ 100,000 (+ possibility to include spouse and children) |

| Free passes to airport business lounges | — | + |

| The ability to earn miles from airlines | — | + |

| Extra sticks (concierge, etc.) | — | + |

| Service cost | 1890 rubles per year | 1990 rubles per month or free of charge if conditions are met |

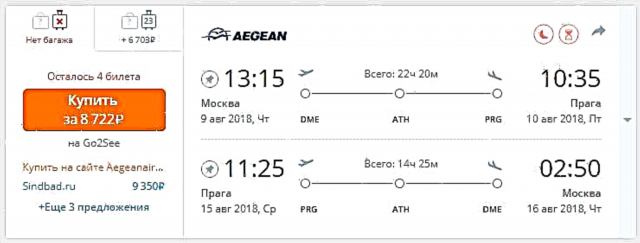

* 7% are credited if you buy tickets through Tinkoff. Travel (and it doesn't matter where he takes you); 2% - if directly on the website of Aeroflot, Pobeda, S7, Utair and Ural Airlines; 0% for other services and sites.

** for example, if a ticket costs 6,700 rubles, 9,000 miles will be debited for it (and even 9,000 miles will be removed for 6001 rubles); for 9,500 rubles - 12,000 miles, etc.

*** for example, if a ticket costs 6,700 rubles, 6,700 miles will be written off; and if 5,400 rubles - then 6,000 miles (because the conditions of write-off are from 6 thousand miles).

**** You can COMPENSATE any air ticket of any airline with miles; but miles are CALCULATED only according to the first asterisk.

And these are all my cards from Tinkoff - credit and debit (I wrote a review about debit Metal recently)

What happens to the accumulated miles when you switch from Basic AA to Premium AA?

Miles do not burn, they are transferred - I specified that. You only change tariffs inside Tinkoff. Actually, that's why you can't have two credit cards or two debit cards of the same bank.

An interesting (and profitable) moment.

The day after receiving the card, 1,700 miles were credited to my account. As you can see from the sum, this is not a friendly bonus. It turned out that if you buy tickets on the TinkoffTravel website, then you will automatically get a virtual account, where the welcome 1500 miles go and 5% from each ticket purchase. When you finally get yourself an All Airlines or AA Black Edition, virtual miles are credited to your account! Full terms and conditions are here.

All Airlines premium credit card terms

The Tinkoff premium credit card can be free of charge. The conditions for a credit card and a debit card actually duplicate each other, so it is more profitable to issue both at once, the conditions of one will cover the second.

- In order for the Tinkoff premium card to become free, according to the terms, you need to keep at least 3,000,000 rubles in any bank accounts. Both cards and deposits are suitable - by the way, at opening they give 0.5% per annum additionally, and IIS, and brokerage.

- Of course, I would not like to keep that much in the bank, so there is a “relaxation” (ha-ha) - to spend 200,000 rubles a month and keep 1,000,000 rubles in accounts.

For a while, I fulfilled the conditions for free, but then I realized that it was difficult and started paying 1990 rubles a month for the bank's premium rate. It seems like a lot, but in a month my fee pays off. And at the time of large purchases (for special offers) or trips abroad, the cards are worked out for several months in advance.

The All Airlines Black Edition credit card is covered by the “Bring a Friend” program - by registering a card using this link, you will receive a 2 month bonus free of charge (which is equal to 4000 rubles)!

Business lounges with Tinkoff card - how do I get 4 passes per month?

Now there are two main cards for me - All Airlines Black Edition credit and debit Metal

Note! Since April 2021, the conditions have changed slightly, now 2 passes per month are accrued as standard, regardless of how many cards you have. But if the conditions are met, you can get more:

|

Over the past years, business lounges for me have become an important facility at the airport, where you can eat, sit with your family, work or be in silence. Therefore, going to business lounges for free using the Lounge Key is a mandatory moment for me in premium cards. Some of my friends use the offer from Raiffeisen for 20 thousand rubles a year, but if, like me, 4 passes a month are enough for you, then it is better to choose a card from Tinkoff.

As I said above, it is beneficial to have two premium cards at once - a Black Metal debit card and an AA Black Edition credit card. For each you will have 2 aisles with a Lounge Key.There is no need to take loans on a credit card and go into debt - it is important to have your head on your shoulders and make sure that it is not you who work for the card, but the card for you! If you store at least 3 million rubles on all accounts (including investments) - 4 passes.

After a separate physical Priority Pass card, which I had been using for a long time in other banks (before the change of fabulous conditions), it was unusual. Lounge Key - it is tied to the bank card itself - first debits money, and then returns it within 3-5 days. But even by chance you won't forget the card :)

And further.

2 passes are credited every calendar month, i.e. if you spent November, then the next 2 passes are activated on December 1. Thus, it is beneficial to fly at the turn of the month and get 8 passes. Small children under 2 years old are admitted free of charge, for information. We have a separate text about business lounges, which I advise you to read.

Benefits of a premium card - pros and cons

I took a photo with a map to show that I really use it 🙂

Now it is difficult to find one card that would satisfy all my wishes - once it was a bundle of premium from B&N Bank and Tinkoff Black, but times have passed, and the bank is now Opening with uninteresting offers. Therefore, you have to have several cards, and All Airlines is one of them.

Let's start with the pros:

+ Cashback for everyday expenses 2% - it is much easier to save miles, 1 mile = 1 ruble.

+ From 2 entrances to business lounges.

+ Good insurance for a year for the whole family - you can add not only a spouse, but also a boyfriend / girlfriend, it's great! I added Irina :)

+ For a year now, the option "Causing damage to third parties: USD 3,000" appeared. if you rent a car abroad, it is not necessary to take extended insurance.

+ A broker account in Tinkoff at the "Trader" tariff is free, saving an additional 490 rubles every month.

+ Increased card miles limits.

+ The presence of installments for purchases from 1000 rubles is a pretty cool feature. Recently, Tinkoff announced the possibility of an installment plan for any purchases from 1000 rubles: you buy - you choose the installment term - you pay without interest. Previously, there were only selected stores with whom the bank cooperates. A commission is taken for opening an installment plan, which depends on its term.

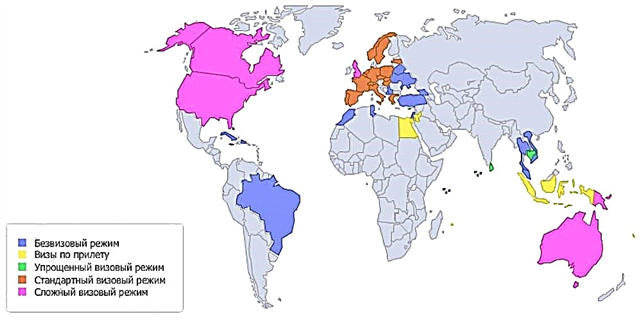

+ An excellent tool for applying for Schengen visas - a credit card statement is suitable as a certificate from a bank.

+ The card is issued by MasterCard, which means that promotional bonuses from the payment system are also applied.

Useful links and bonuses from Tinkoff that will be useful to you:

|

Now the cons of AA Black Edition credit cards:

- Expensive service is the main disadvantage of this card. And the free conditions could be a little less ...

- A 55-day interest-free period is, of course, good, but some banks give even 100 days. I do not need this, but it should be attributed to a minus.

- The card is not suitable for those who fly abroad and buy tickets exclusively on the websites of airlines - cashback is not charged for the websites of foreign airlines, please use Tinkoff Travel.

- Automatic withdrawal to overlimit / overdraft - 390 rubles per operation no more than 3 times during the billing period. You can ask to turn it off.

- Well, you can only compensate for air tickets within 90 days after purchase, do not forget.

In the insurance, by the way, the assistance is indicated - Europ Assistance, suddenly it is important for someone. In terms of quality, it is a good average.

As a result, my review of Tinkoff Premium is positive. The bank more than once went to meet in my own jambs (for example, if I did not specify the details or did not read the conditions for calculating the cashback until the end). Therefore, of the minuses, I can really single out only the cost of the card. I have not compared the accrual of interest for late payments with other banks, since I have never violated them and therefore did not overpay, which is what I wish for you! In general, the negative towards loans and credit cards is understandable, but my advice: you need to be sensible and not take a credit card for the sake of a bunch of useless purchases, then everything will be ok.

I have been using Sberbank's premium for a while, but I stopped it, because in fact, apart from the passage to the business lounges, there is nothing interesting there. Plus, insurance cannot be extended to a girl. The same thing with Otkrytie - conditions change too often, and insurance is not very good. Earlier, BinBank had 7% cashback and unlimited passages for 400 thousand per month, eh ...

Therefore, at the moment, the premium card from Tinkoff All Airlines Black Edition in conjunction with the main debit Metal is an excellent and suitable solution for me on the market.