In this article, we will tell you how to choose travel insurance for traveling abroad and getting Schengen online. We give advice and point out the nuances when buying a policy for a long trip. Is it worth it to draw up, what to look for, how to get compensation, other points.

The beginning of 2021 turned out to be nervous and tense for tourists. Someone could not return home in time due to the avalanche-like closure of borders in connection with the coronavirus pandemic. Someone is still deciding issues related to the cancellation of flights and cancellation on vacation. I would like to believe that everything will be resolved safely and in July vacationers will be able to spend their vacation at sea. Today we will talk about how to choose insurance for your vacation and protect yourself and your loved ones as much as possible in a difficult situation in the travel market.

How to choose travel insurance?

Many people think that travel insurance is a formality, mostly necessary only for obtaining a visa. And if you really buy it, then the cheapest one with a basic set of options is best. This is a fundamentally wrong decision. However, as well as trying to issue the most expensive one with all the additional services.

Before traveling, you should carefully consider what exactly can happen on the trip and what items you might actually need.

- If you are planning a quiet beach vacation without minor children, and everything is in order with your health, there are no chronic diseases, then we recommend that you take a closer look at the standard option. Making a similar insurance policy necessary for obtaining a visa.

- We advise you to think about additional options for those who intend to do active sports on vacation, travel around the country by bike or car. Not all companies include the cost of post-injury treatment in the basic package.

- In the current epidemiological situation, it is worth paying attention to such additional services as travel cancellation insurance, which will help to return money in case of illness of the traveler himself or his loved ones.

- When traveling with children, we advise you to look for a company that will help send the child home in the event of the death or hospitalization of the parents. There are insurers that compensate for the costs of flights of relatives to a seriously ill patient.

- When traveling with children, we do not save money and choose the maximum package. Especially worthy of honor are such cases: sunstroke, allergies to local fruits, burns, injuries (for example, when traveling on a rented bike in Asia).

Separately, we will highlight dental services and insurance for pregnant women. Few companies are willing to pay for expensive services. But if a toothache can be endured, then when choosing insurance for the travel of the expectant mother, he is stopped on policies that guarantee help in case of problems.

We advise! When planning a long trip abroad, be sure to draw up a policy in advance for the period that you need. While in Russia, you can choose more companies that provide the service. If you are already abroad and want to get a policy, then first of all we advise you to use large companies: Allianz (Mondial), Tripinsurance, Rosgosstrakh, Renaissance (Class Assistance).

- Also, you should understand that when you are already abroad when applying for a policy, the cost for a long term insurance will be high... This is how the insurer protects itself from losses. The chances of getting sick while living in Thailand for a long time are much higher than on a standard vacation for two weeks. When choosing a company, be sure to find out for what maximum period they can provide a policy: for 182 days or for a full year. While not in Russia, you can only apply for a new policy, renewal is not possible.

- Do not postpone registration until tomorrow, as the cost also depends on the local currency rate.

Rating of the best insurance companies for 2021

How to choose travel insurance and what points to focus on - we figured it out. Now let's talk about insurance companies. When choosing an insurer, you should be guided by its reputation, reviews of travelers, the market segment it occupies and, of course, the number of services it offers and the terms of cost compensation. Below we give a small rating of reliable companies offering travel insurance in 2021.

- Renaissance insurance sells inexpensive insurance for vacationers. The standard policy includes reimbursement of expenses for medical care in emergency cases, as well as transportation of the patient. One of the advantages is the presence of the SafeTrip mobile application, which helps to instantly contact representatives of the company abroad. Of the minuses, most injuries are not covered by insurance claims. They must be included in the insurance policy additionally. The company denies insurance to people over 65 years of age.

- Insurance Company "Agreement" offers an excellent standard package at a very reasonable price. It includes medical coverage of $ 5,000 for complications during pregnancy up to 28 weeks and for exacerbations of chronic diseases. For an additional fee, you can take out travel cancellation insurance. "Consent" will fully reimburse the cost of the tour. Travelers also note the availability of communication with representatives of the company abroad. The disadvantages include the inability to open or extend the validity of the insurance policy abroad. Moreover, some options are also unavailable when processing documents online.

- Insurance in "Ingostrahe»Is more expensive than the companies listed above. In addition, only two additional options are included in the basic package. But essential. Assistance in returning home of underage children in case of illness of adults and payment for the flight of relatives to the patient. In addition, the company recognizes as an insured event most of the herbs obtained during rest. Additional options offered include baggage and cancellation insurance. On the negative side, we note that the insurance policy is issued for at least 7 days.

- European insurance company ERV proposes good travel insurance in Europe. Most travelers consider the offered conditions to be optimal in terms of price / quality ratio. They work with chronically ill people and pregnant women. The standard policy includes emergency care for exacerbation of chronic diseases, allergic reactions, insect bites. The help of Russian doctors is available through the Telemedicine communication channel. Will not leave the company in trouble even in the event of a natural disaster or other force majeure circumstances. A pleasant bonus is the absence of increasing coefficients when insuring children and the elderly. Coverage for travel to most Asian countries is US $ 100,000. Also, the company necessarily includes a number of additional services, which makes insurance much more expensive than competitors. By the way, ideal for a trip to Thailand.

- Company "Alpha Insurance»Offers clients a full range of options, including dental care, surgery, injury and accidents. Something is included in the standard package, something is paid additionally. But, thanks to the average prices for travel insurance, its registration is not affordable. According to numerous reviews, the company is one of the most reliable, operating on the territory of the Russian Federation. True, in order to pay compensation, you will have to collect a lot of papers.

In addition, we advise you to take a closer look at insurance companies such as “Tinkoff», «Liberty», «ALLIANZ". Each of them has its own "chips" for attracting customers, advantages and disadvantages. But travelers are all different. Everyone has their own problems and wishes.

Make travel insurance:

What points in insurance to pay attention to

When registering honey. travel insurance We recommend that you pay main attention to such moments.

- What exactly is an insured event. This is especially true for basic insurance. It may be worth including some additional points that cover injuries, accidents, allergic reactions, insect bites.

- Conditions for the occurrence of an insured event. For example, if a company does not work with people with chronic diseases, then an exacerbation of hypertension is not an insured event and will have to be treated at its own expense. The same applies to complications during pregnancy or premature birth.

- Assistance companies. Simply put, medical institutions that will deal with treatment. Insurers often work with multiple healthcare institutions. We advise you to know about them in advance, read reviews before making a choice. Especially if there are health problems.

- Forms and channels of communication with representatives of the insurance company. Large insurance companies often have branches abroad.

- Often, pitfalls await in the most inappropriate place. Often, the standard policy prescribes how many times you can use medical help. For example, one doctor call or one outpatient visit, several dressings. Everything that will be in excess of the agreed conditions can be paid out of your pocket.

- Dates of the policy. It is important that he works even after the expiration of the terms of the contract, if the vacationer falls ill 1-2 days before departure and is in hospital.

- Conditions for payment of compensation. What documents, where and in what time frame you need to submit.

- The correctness of the specified data about the traveler. One inaccuracy in the policy may cause a refusal to provide medical care at the clinic declared by the insurance company.

Important! No company will make a payment if the health condition has deteriorated as a result of alcohol abuse. And this item often includes not only injuries, but also hypertensive crises, heart attacks, and poisoning.

Before the trip on vacation, be sure to study the issued policy:

- find the serial number,

- check for the presence of the seal and signature of the person in charge,

- find phone numbers when an insured event occurs and highlight them.

What is included in the standard tourist package?

The list of options depends on the company. Usually, the standard policy includes compensation for the costs of emergency medical care, transportation of the patient to the place of treatment. Medical care is understood as a complete package of measures to stabilize the patient's condition. This includes the necessary studies for diagnosis, medications, procedures and other manipulations. In large companies, the list of services also includes transportation of the patient to the place of permanent residence.

Currently, there is a real struggle between insurance companies for clients. Standard packages include options that have recently been additional and paid for according to a separate price list. Most often, this is the return home of the minor children of the insured person who were left unattended, reimbursement of the expenses for the trip of relatives to the sick or injured person. Often fall under the insured event and the need to interrupt the vacation due to the death or serious illness of loved ones. In this case, the flight costs will be partially or fully compensated.

We advise you to separately issue compensation for cancellation through Compensair. The service helps to refund up to 600 euros for delayed and canceled flights, overbooking.

Types of travel insurance

Vacation insurance today is not strictly medical. Companies offer a ton of additional options. Naturally for a fee. But they don't make insurance much more expensive. Especially the possible costs of treatment.

What additional types of travel insurance worth paying attention to.

- Travel cancellation insurance. Insured events include illness of the insured person, death or hospitalization of his relatives, problems with obtaining a visa, lawsuits, conscription, damage or theft of property. The policy will reimburse the cost of a tourist voucher, tickets, the cost of a visa or a consular fee.

- Extended injury and accident insurance. Often, injuries are not included in the standard policy when it comes to tours to Southeast Asia or to ski resorts. If you are going to engage in extreme sports, then it is better to purchase an additional package or increase the limit for covering the costs of medical services. This also applies to countries with an unfavorable epidemiological situation.

- Luggage insurance. The cost of the service is 5-10 US dollars. But in case of loss, you can console yourself with a financial payment.

- Third party liability insurance. Designed for fans of extreme sports. Often, during skiing or snowboarding downhill slopes, collisions occur, in which not only people suffer, but also expensive equipment. If the guilty person has insurance, there is no need to worry about compensation for damage. Some companies even offer insurance against bad weather at the resort. They will reimburse the costs of studying at school, renting equipment, and SKI-pass for skiing, if they were not able to be used during the rest.

Note that most insurance companies try to adapt to the client. As a rule, a standard policy is formed, and then the traveler himself selects the options he needs. The exception is the policies included in the price of the package tour, which are purchased by travel agencies. They have little coverage, ranging from $ 15,000 to $ 20,000, and a minimum set of services.

You will be interested in:

- How to buy cheap flights?

- Inexpensive taxi and transfer rental.

What is a Franchise?

In simple terms, this is the part of the income that the insurance company will keep for itself, regardless of whether it has to reimburse the expenses of travelers. It is used by all companies and not in all areas. Most often, these are the countries of Asia and Africa. The average deductible is $ 25-50.

What does the insurance cover?

Insurance for traveling abroad fully covers the traveller's expenses related to the insured events specified in the insurance policy. The amount of compensation is limited by the so-called coverage or the amount for which the traveler is insured. The minimum amount is USD 15,000. According to insurance experts, this is not enough. Better to expand your policy to $ 30,000 and include additional options.

It is clear that travel insurance price depends on the amount of coverage, the availability of services in excess of the standard package, the number of days of stay abroad. For example, in the AlfaStrakhovanie company, the cost of basic insurance will be 1,540 rubles for 10 days with coverage of 50,000 euros. If you add options such as travel cancellation, baggage, civil liability insurance, the coverage will increase to 100,000 rubles, and the price of the insurance policy will increase by 1,000 rubles.

Where to buy travel insurance online?

Not all companies have the option to buy travel insurance online. But any insurance company with a good reputation has a website. It describes in detail how you can purchase, issue and pay for an insurance policy.

Cherehapa

If you have not decided on the insurer yet, then on the website Сherehapa you can familiarize yourself with the insurance conditions when traveling abroad and find out where to buy travel insurance online.

Why do we recommend Cherekhapa? An online aggregator that saves time looking for the best insurance options, both in terms of price and service. You go to the site and choose the option you need. No need to search for official websites and compare prices, all in one place. The cost of registration is absolutely the same as on the official website, some insurance companies sell the policy even below the price (due to the high volume of online sales) indicated on the main website.

When looking for a policy online on Cherekhap, we must use the right menu, it allows you to fine-tune all the necessary points. A very convenient thing that other units do not have. In the picture, we have marked the main points with a tick, which we use constantly when traveling.

Tripinsurance

Another mediator who should be trusted when planning the best holiday abroad is Tripinsurance... The service has been personally tested on myself many times and under different circumstances.

Let's immediately note the pluses: they have an ideal assistance service that will help in any situation and tell you how to be and what to do in the first place when an insured event occurs. They offer only large and large players proven by many years of experience. If you do not know who to choose, you can ask a question online, they answer in detail and quickly.

Disadvantages appear only when the tourist decided to save money and chose the minimum cost of medical care. This is especially true for tourists leaving for Asia, where treatment costs fabulous money.

When traveling together, the package is perfect Standartbut with children it is better to consider Million, but this is already your choice.

There are other services too - instore, sravni... You can use them, but we did not find any advantages for ourselves here, ranging from an increased commission to a weak service. Perhaps you have a different opinion on this matter, be sure to share it in the comments.

What to do when an insured event occurs?

For starters, it's worth remembering! If you get sick on vacation, then be sure to we require a doctor due to very poor condition. We never say that you have come on vacation already in poor condition or have been sick for a long time. We do not self-medicate! All of these points can affect the denial of insurance compensation.

- To begin with, you should contact the hotel administrator at the reception, he will help coordinate further actions and contact the insurance company. Or immediately call the assistance service at the federal number indicated in the policy. Here you will be told the address of the hospital where you need to go. In severe cases, from our experience, upon a call, a car will come and take you away for examination.

- Important! In a difficult situation straightaway we call the emergency service and only then in the assistance!

- When you go to the hospital, be sure to have a health insurance policy and a passport with you. We recommend keeping photos of documents on your phone, depending on the situation, you may not have time to collect the package of documents.

- When submitting documents and filling out a questionnaire, the hospital may ask you to leave your passport and send it to a doctor for examination. While you are with the doctor, the information from your assistance is being processed and verified, the service must contact the hospital in advance and inform them of your arrival.

- When examining, do not forget to tell about drug intolerance.

- If everything is in order, you are given medicines for free and sent home (we were personally taken back in Turkey in the same car).

If the doctors have prescribed a second appointment after treatment, be sure to contact the assistance and inform about all further steps. If there is no hospital nearby, with which the assistance works, then the treatment is carried out at your expense and upon arrival home the costs will be reimbursed. It is important to bring a complete package of documents to the insurance company.

Standard list of documents for compensation for treatment:

- policy,

- payment receipts: communications, transport, medicines, doctor's appointments, additional medical services,

- insurance claim application,

- medical documents.

We recommend taking pictures of all documents at once on your smartphone.

Should I make travel (medical) insurance when traveling in Russia? Here you can get by with the compulsory medical insurance policy, but when hiking in the mountains and traveling to ski resorts in winter, we must make out!

How do I get paid for insurance?

In the event of an insured event, we advise you to urgently contact the service department of the company, and they will coordinate your further actions. Then medical assistance will be provided free of charge, and all financial issues will be resolved between the insurers and the medical institution.

If this is not possible, we recommend that in case of refusal of service under the insurance policy without a message from the service department, pay for the necessary procedures, ask for an invoice and try to get in touch with the support service in order to continue the treatment for free.

The conditions for making payments and the package of documents required for them can be viewed on the company's website or by phone from a consultant. Vacation is a lot of fun. However, it is worth playing it safe.

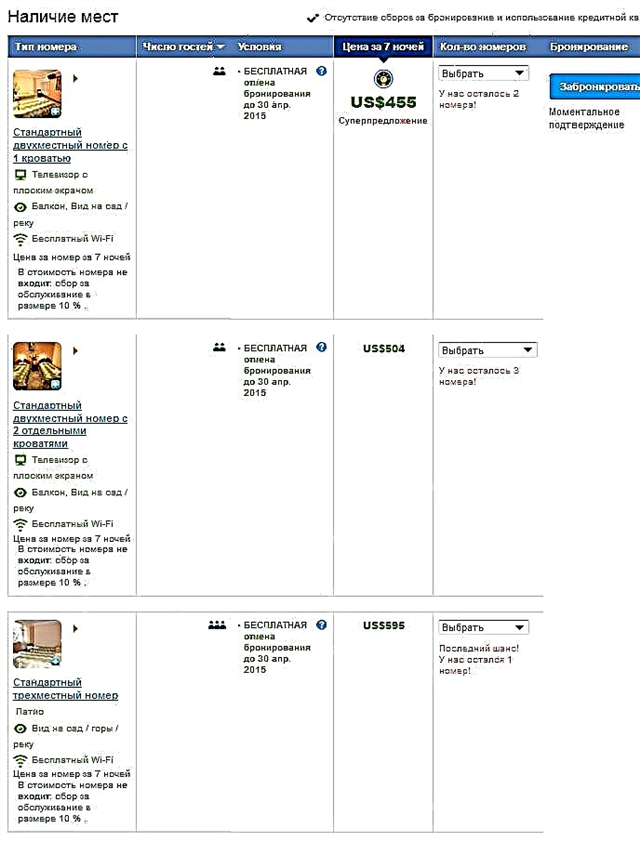

How to save on hotel reservations?

We go to Booking and choose the option we like from a huge hotel database across the country, read reviews, look at photos of rooms, descriptions. Then go to RoomGuru and look for this hotel here. The service will display price options from different booking sources. You just have to choose the cheapest offer and book a room. Often the cost varies from 20 to 35%.

If our reader suddenly has questions about how to choose travel (medical) travel insurance, which services are better to use and who to trust - we are waiting for comments and will definitely help with advice. We wish you a successful trip and more sunny days.