Author: Igor

“If you think about traveling and retired, get ready now,” so I concluded and began to delve into investments. A year has passed, I tell you what and how.

I opened investments from Tinkoff Bank exactly 1 year ago - this is my first broker. But I have been a client of the bank for several years now: I have found offers for myself that are beneficial both for everyday spending and for traveling abroad, here are my reviews.

I started a brokerage account at Tinkoff with the expectation that something large-scale was coming at the beginning of 2020, I wanted to prepare for buying shares on the collapse. I entered the market in February and formed the main portfolio during the fall in March - as a result, I made good money, in this article I will show the percentage yield. A year later, I understand that then it was JUST LUCK: the right time and place. Now I am much more savvy in investments, but one thing remains unchanged: broker Tinkoff. This is my main instrument, although I opened an additional account with another broker.

Well, let's analyze the pros and cons - at the heart of my experience and friends' reviews about Tinkoff Investments. We even have a general chat on this topic :)

10 pluses of Tinkoff Investments

Basically, I buy stocks for an average period (from 2-3 months to 1 year), sometimes I try speculation, but this is not completely mine. I am still waiting for additional brokerage accounts to appear in Tinkoff - this is very convenient, because one can play for a long time, and on the other one can try to speculate for a short time.

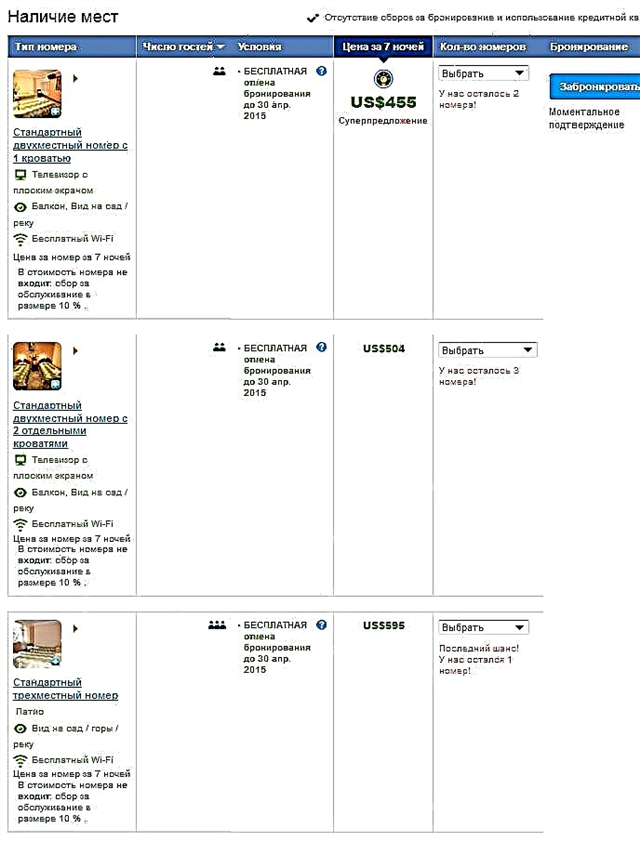

My estimated 1 year return on the right - in a growing market in 2020 it was not difficult

Pros of the broker Tinkoff:

+ Easy to use. Triple underlining. Take a look at the app of any other broker, and now at Tinkoff. And again to another broker, and again to Tinkoff. They are really "on horseback"! From a complex, visually overloaded tool, Tinkoff made an application comparable in convenience to a photo editor on a phone.

Interesting numbers. Since April 2020, broker Tinkoff has been ranked first in the Moscow Exchange in terms of the number of both new and already registered active clients.

+ Fast support service. Right there in the appendix. The other day I spoke with the support of another Russian broker - well, how did I communicate, I asked a question. They answered me ONLY the next day.

+ Purchase of currency from 1 dollar. Some brokers (for example, Sberbank or Otkritie) have restrictions of 1000 units for buying and selling currency. That is, you can only exchange from $ 1000 or € 1000 - great, but what if I'm a mini-investor with a mini-portfolio? :( (hint: I'm at Tinkoff).

+ Access to the US premarket and postmarket. I decipher: shares of American companies can be bought before the opening and after the close of the American market. This is very convenient, I don’t have this in another broker, I have to place an order and wait for the opening of American trades. And in the premarket, stocks often go up or down!

+ The broker will pay taxes for you. You can make thousands of transactions and not worry, you don't need to count anything at the end of the year. Tinkoff automatically deducts 13% of the profit when you withdraw the earned from the account. You need to pay extra tax only for receiving dividends, if any.

Some of my successful deals are Chipotle and shares of Tinkoff bank itself

+ Social network Pulse. Yes, the broker's application has its own social network with subscribers, subscriptions and discussions of promotions. Mostly they write a lot of garbage and launch rockets, but you can also figure out something new. For example, I like news digests and expert posts from knowledgeable people (but they need to be found in a stack of "mother's" investors).

+ A good TradingView terminal. Judging by the feedback from Tinkoff Investments clients, it is good. I do not use the terminal (while I am taking a course for this), but, they say, it is more comfortable to sit in it than in the broker's web version.

+ Possibility to open IIS. And get a deduction of up to 52,000 rubles for the previous tax year (type A or type B deduction). I am filing this year and I hope to get some of the taxes paid on my stock earnings back. By the way, since April 2021 you only need to pay for one tariff, they have been combined. Previously, the commission for a brokerage account and IIS had to be paid separately.

When choosing a broker, it is important to understand: you can always refuse it or register a dozen more brokers at the same time. But IIS can be opened only one.

+ Bonus when opening a brokerage account. Now it is 1 month of trading

no commission, take away →

+ There is no commission for deposits, withdrawals, and sometimes even for service. We threw rubles on the broker for free, traded and withdrawn profits for free (but tax deducted, of course). If you don’t buy or sell anything for a month, then you don’t pay for service either. But it may be different: brokers are often not free. For another account, I give $ 10 a month.

Cons - what's the catch with Tinkoff Investments?

Margin trading is enabled, but there are no short stocks available 🙁

Well, now the cons. Without them, I would not have opened an account with a foreign broker (Interactive Brokers), at the end of the article I will write a little about it.

1. Glitches-glitches-glitches. Although Tinkoff made it to the top of Russian brokers, their application is new - and therefore crude. Coping with a frantic influx of customers without breakdowns is not so easy. To be fair, I will say that compared to the spring of 2020, there are now fewer mistakes.

2. Substantial commission per transaction. At the basic plan "Investor" one of the largest commissions on the market - 0.3%! To lower the percentage, you need to raise the tariff, but with certain conditions (more on this in the next section).

3. Not all fin. tools have access. For example, I'm interested in Airbus shares or real estate ETFs - but I can't buy them, because I need the status of a qualified investor (it's not easy to get it).

4. Incorrect display of income and loss percentages. No matter how much I argued with support about this, they always open up. In fact, it does not affect anything, but it does affect the nerves. Many people advise keeping records of their transactions on the intelinvest.ru website - it is convenient and understandable, and the percentages are all accurate. And what could be more important in investment, if not accuracy?

5. Some stocks cannot be short. Or play on the downturn of the market. This, as I understand it, is due to the lack of liquidity on some shares. In principle, this can be attributed to the pluses, less temptation.

As a result, I like the customer focus of the bank and, accordingly, of the broker. For a novice investor or trader, Tinkoff Investments are ideal - do not forget about the bonus when opening an account.

But after a couple of months, when you have mastered it and if you intend to dive deeper into the topic of various fin. instruments, you can open in addition a second account with another broker. I chose a well-known foreign Interactive Brokers - yes, it is half in English (I give the link to the referral program, through which I will not earn anything, but you can get shares of the broker itself). But it gives access to a large international market without qualifying status and insures the money in the account.

Tinkoff broker tariffs - which one to choose?

In my opinion, if you buy and sell something every month, it is more profitable to issue the "Trader" tariff

There are three tariffs in Tinkoff Investments.

Investor. The initial tariff that is activated when you open an account. Service on it is free, and the commission for a transaction (both with currency and with shares) is 0.3%, which is a lot. But if you do not plan to trade every day, the free service on this package at Tinkoff compensates for everything. Not every broker has this.

But be careful when you start trading big. A funny thing happened to my friend: he completely forgot about his basic tariff and traded with his shoulders - he bought shares for $ 30 thousand and paid about $ 42 commission for the purchase and then the same for the sale! When on the next tariff the Trader would get $ 7 commission.

Trader. My choice at the moment is 290 rubles per month, but it's free if there is a premium card from Tinkoff (good card, my review is on the link) or if you haven't bought / sold anything for the whole month. Commission per trade 0.025% –0.05%, depending on the daily turnover.

Premium. It costs 3000 rubles in the first month of service, then 990 rubles, if the account has more than 1 million rubles. A fixed commission of 0.025% per trade, access to an extended package of securities (but again, not all that I need). At this tariff, you can get the status of a qualified investor, which I plan to do soon - all the requirements for this are met.

Commissions in Tinkoff Investments, as you understand, depend on the tariff. I chose the "trader", the most optimal one. If you read the reviews of clients who have invested in Tinkoff Investments, this is the most popular tariff. If you plan to buy a little and not sell for a long time, the "investor" tariff is suitable.

What is the terminal in Tinkoff Investments?

Terminal in Tinkoff Investments from TradingView, which is very good, because everything is intuitive - I have not personally used it much, so I rely more on the reviews of friends and other clients. If you take a separate subscription to the service, then it costs from $ 15 per month!

The terminal, most likely, if you are reading this text, you will need it a little later. Here is more about him - there are innovations of the last year, and examples of charts. I will attach a few below for presentation. Also, many investors use the QUIK platform, but for a beginner, an application in a phone is enough.

My review about Tinkoff Investments

I actively use the bank's infrastructure - these are my two main cards (debit Tinkoff Metal and credit All Airlines Black Edition)

Over the past year, I have taken many different courses, read a couple of books and tons of articles and investment analytics, but now, in 2021, at the time of this writing, I am taking a trading course - not to do it, but simply to better understand charts and entry / exit points on medium-term investments. In short, I try to develop and delve into the topic of finance, which no one has ever taught me.

For many, Tinkoff solved the main issue - they lowered the threshold for entering investments. For which I am very grateful to them: earlier, in the year 2017, I thought about the exchange and went crazy with the number of incomprehensible buttons and charts, long reviews and complex settings. Now everything is much easier, and it's super.

After 1 year with a broker, after reading a lot of customer reviews of Tinkoff Investments in Pulse (local social network *) during this time, I can say that this is, if not the most, then definitely one of the most convenient brokers in Russia. I have seen the offices of other brokers, and there an investor will break his leg, especially a beginner. Therefore, I can fully recommend him for a start in investment. A year later, I actively buy and sell something in this broker, although I got a new one. Of course, the application is not without its drawbacks, but the scale definitely goes towards “open an account”.

* the topic with Pulse, by the way, is very cool - you can talk to like-minded people, and ask some questions, everything is open and understandable.

If you are a beginner, take investment training from Tinkoff - it was my first starting course, read a couple of articles-reviews of experienced investors, do not use margin trading (do not specifically enable it), do not short the market. AND THE MAIN THING. Take stock wisely. Even if some blogger tells you where to invest, always check the company information yourself.

And of course, each broker must be chosen for specific purposes: someone wants to trade, someone wants to buy less often, and someone generally takes stocks for 15-20 years. Therefore, you need to compare the rates and capabilities of brokers. If you are interested in what courses I have read / watched, ask in the comments.

Now a few words about the second broker. He is foreign.

I decided to open an account with Interactive Brokers in order to close all the disadvantages and add advantages when investing. In order to gain access to a larger number of instruments, insurance (conditionally: as a DIA for a bank deposit) and form a long-term portfolio - after all, the history of our market and brokers is still short. In IB with usability, everything is oo-very bad, also in English. But there are a lot of opportunities - you can buy various eminent funds with a huge history, shares of super famous companies, but which are not traded on St. Petersburg or the Moscow Stock Exchange. If you are not a resident of Russia (moved from Russia / not from Russia at all), then you cannot open Tinkoff, and you need to open an account with another broker - and IB is also ideal for such a case.

Everything that is written in the article is my personal experience, the information is not an investment recommendation.